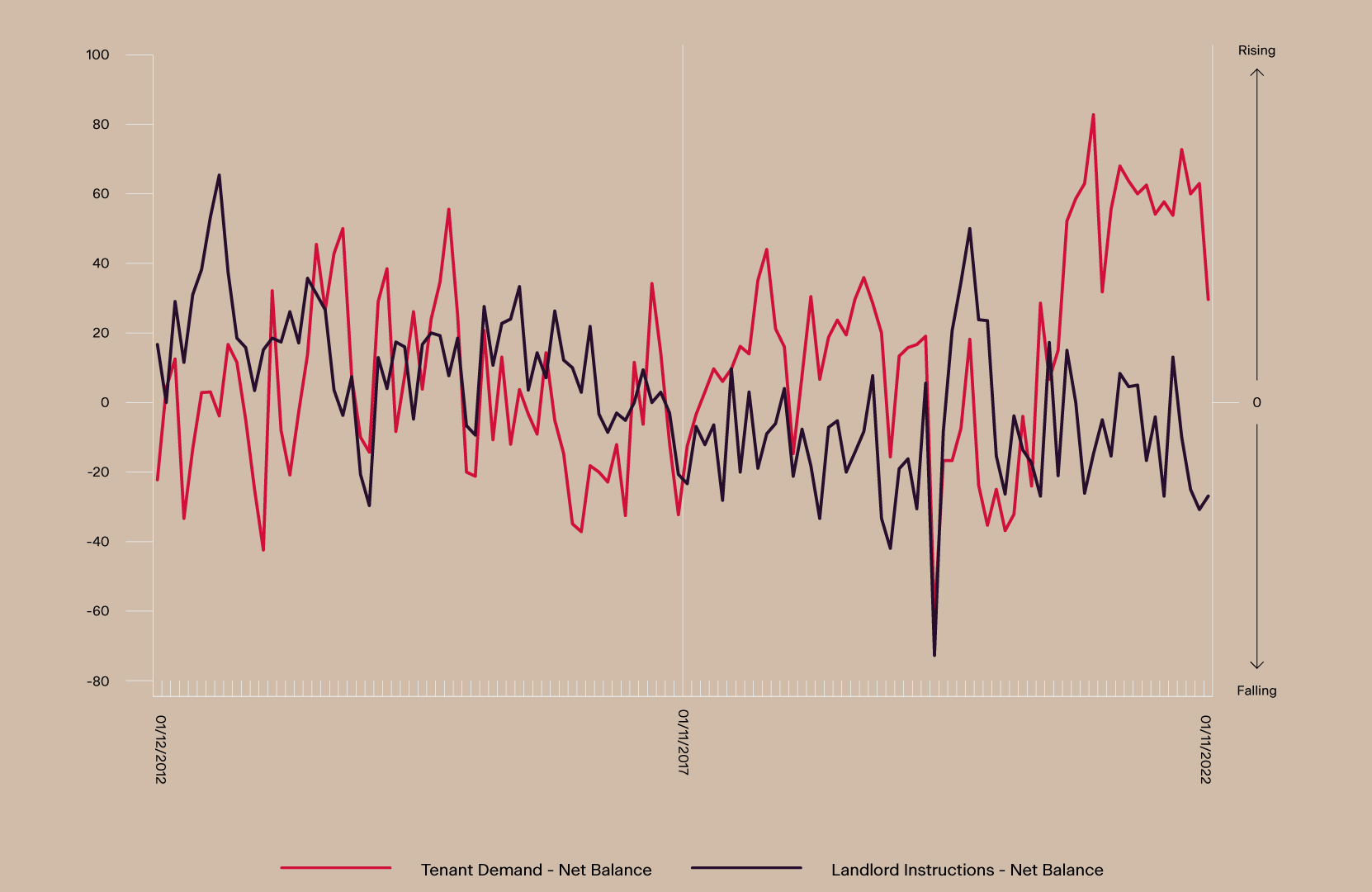

Demand for rental accommodation hit near-record levels in the wake of the pandemic and remains well above long term norms, according to data from the Royal Institution of Chartered Surveyors.

Source: RICS

At the same time, the supply of rental homes has fallen markedly as landlords opted to sell during the strong sales market of 2021 and 2022. There have been more than 260,000 buy-to-let mortgage redemptions over the last five years.

These pressures have been mitigated for new investors by rental growth, which is one of several factors driving interest in the new homes market among landlords – particularly in London, where rents are forecast to grow 15.9% during the next five years, according to Knight Frank forecasts*.

Data from the Build-to-Rent (BTR) market provides evidence of a shift in appetite among renters for newer, more amenity-rich properties. Some large BTR schemes saw lettings volumes averaging more than 100 units per month during Q3 2022, more than five times the pre-pandemic average, according to research from consultancy Molior.

As a result, just 11 BTR developments were actively being let as of the fourth quarter and with fewer than 800 units left to be let between them – for comparison, some 6,400 BTR units were leased during the first nine months of 2022. That suggests there is a significant pool of demand among renters for a constrained supply of well located, modern properties.

Investors in new homes also future proof their investments from incoming changes to legislation that will require landlords to upgrade properties to EPC or above.

Renters of new homes save significant sums on their energy bills which may lead to rental premiums over less efficient properties, though there is little data available to support the claim.

The average new home uses approximately 100 kWh per m2 per year compared with older properties, which require an average of 259kWh per m2, according to calculations from the Home Builders Federation. New build properties save an average of just over £2,000 per property each year, with the average annual running costs for a new build totalling £1,500 compared to an average of £3,570 for older properties.

As mortgage rates rose, the sales market in London weakened and sales rates declined. Molior data suggests there are now 3,000 unsold stock units across the capital available to purchase, which has been broadly stable since 2020 due to slowing construction.

Product choice is improving, too. Lenders that left the market in the wake of the mini-budget are now returning with innovative products and plans to build market share through the new year.

At the time of writing, variable rate products could be found as low as 0.09% over base rate. Many have no repayment charges, opening up the opportunity to profit from lower variable rates while waiting for fixed rate products to fall further.

Other new products now available include mortgages with deferred interest payments – some lenders allow 1% of the rate to be added to the end of the term, boosting how much investors can borrow.

*Forecasts relate to average rents in the PRS. New build rents, such as those in the BTR sector, may not move at the same rate.

Exploring investment opportunities in new build? Contact our specialist team for advice on your financial options via mortgages@knightfrankfinance.com