The mortgage market shakes off the mini-budget hangover

![News Article Image]()

The housing market is gradually shaking off the effects of the mini-budget. Housebuilders, sentiment surveys and official figures have all indicated that activity is strengthening as spring approaches.

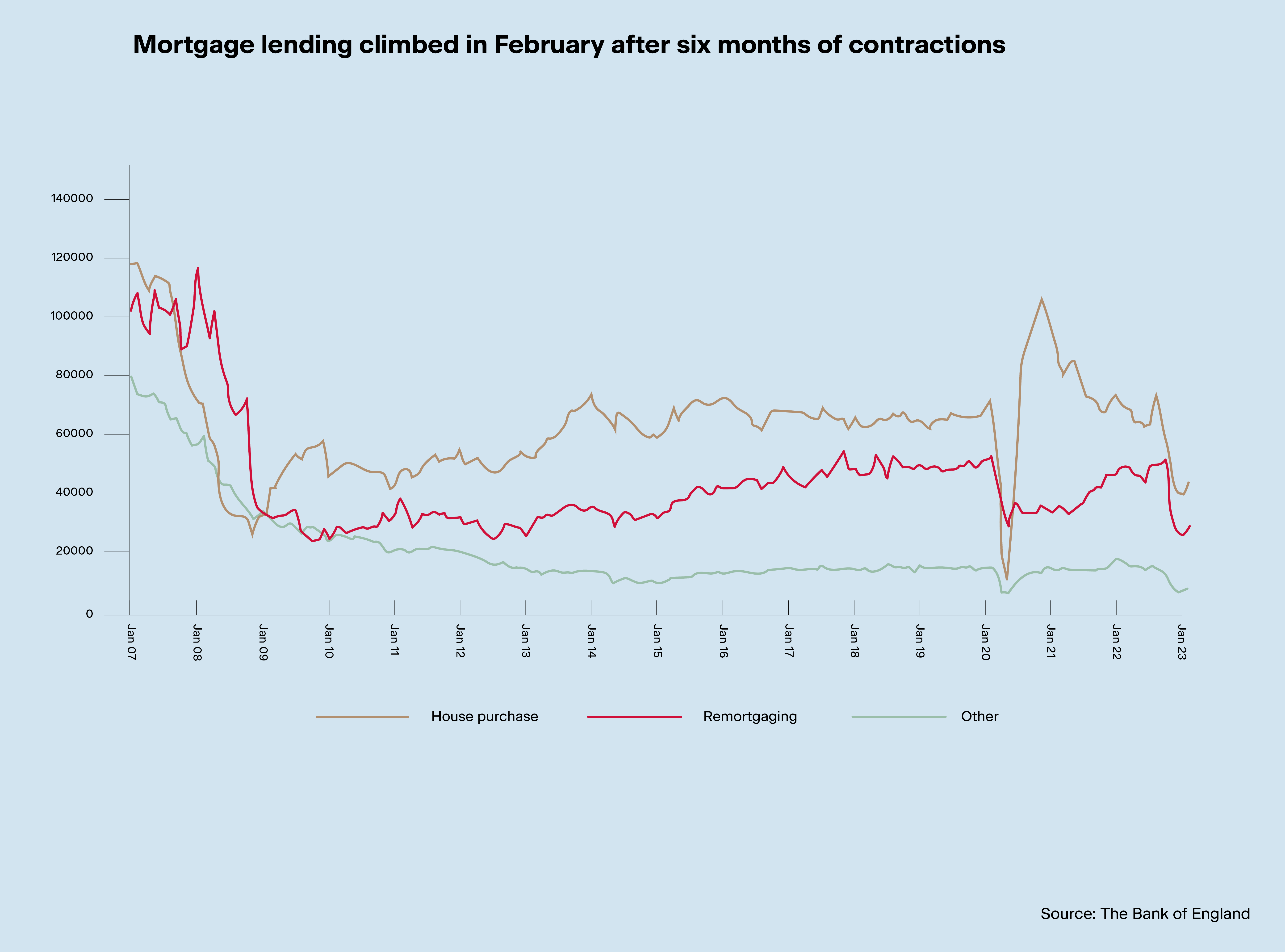

Net mortgage approvals for house purchases increased to 43,500 during February, from 39,600 in January, according to Bank of England figures. That's the first monthly increase since August.

Activity is still subdued relative to recent history, but things will continue to settle the further we get from the mini-budget.

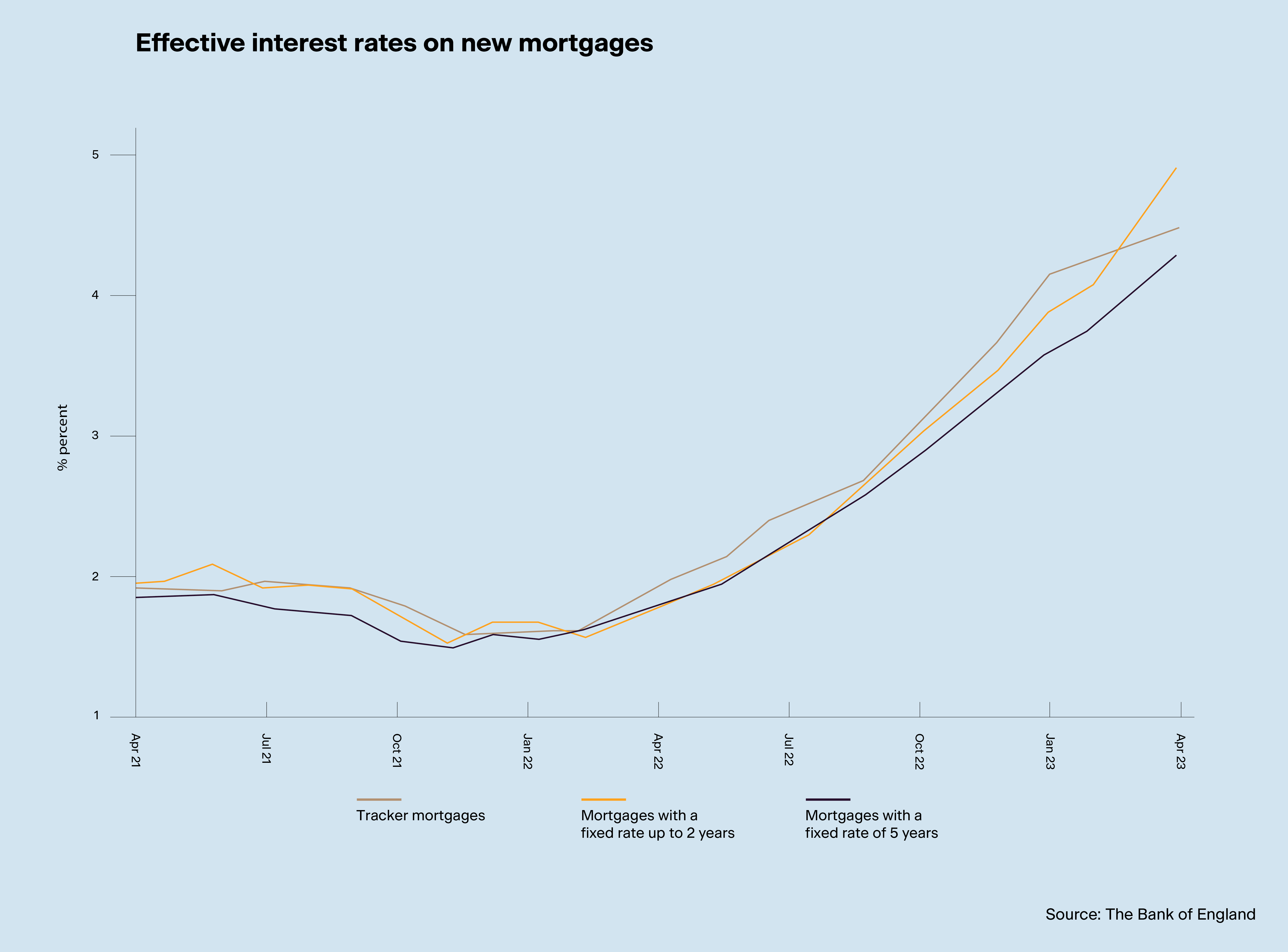

The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 36 basis points to 4.24% in February. We'd expect that to stabilise in the months ahead, though much depends on whether we see any further bouts of financial instability.

The evolving banking crisis that began with the collapse of Silicon Valley Bank in March broadly pushed up the lenders' cost of funding, though the Bank of England noted that, as of its mid- March meeting, they were yet to pass that on to borrowers. Indeed, borrowers can access a wide range of rates, depending on their circumstances. The major lenders are making regular tweaks to their ranges, alternating between small cuts and small raises depending on their oscillating cost of funding and their confidence about the economic outlook.

Unless financial conditions change meaningfully over the coming weeks, however, we believe mortgage rates have found a natural floor and, though we may see more marginal cuts, substantial reductions are increasingly unlikely.

If you would like to discuss how the current market conditions may impact your property plans, or those of a client, please contact us at mortgages@knightfrankfinance.com