Lenders surveyed by the Bank of England say banks are planning to ramp up mortgage lending, particularly to homeseekers with small deposits.

Every three months the Bank of England surveys lenders to better understand trends and developments in credit conditions. The survey covers both secured lending, another term for mortgages, and unsecured lending, such as spending on credit cards.

A new survey conducted in the three months to February and published on Thursday suggests lenders are ramping up for a boom in mortgage lending, fuelled by the rosy economic outlook and a desire to build market share.

Here, we look at three key findings in an attempt to explain this shift in behaviour.

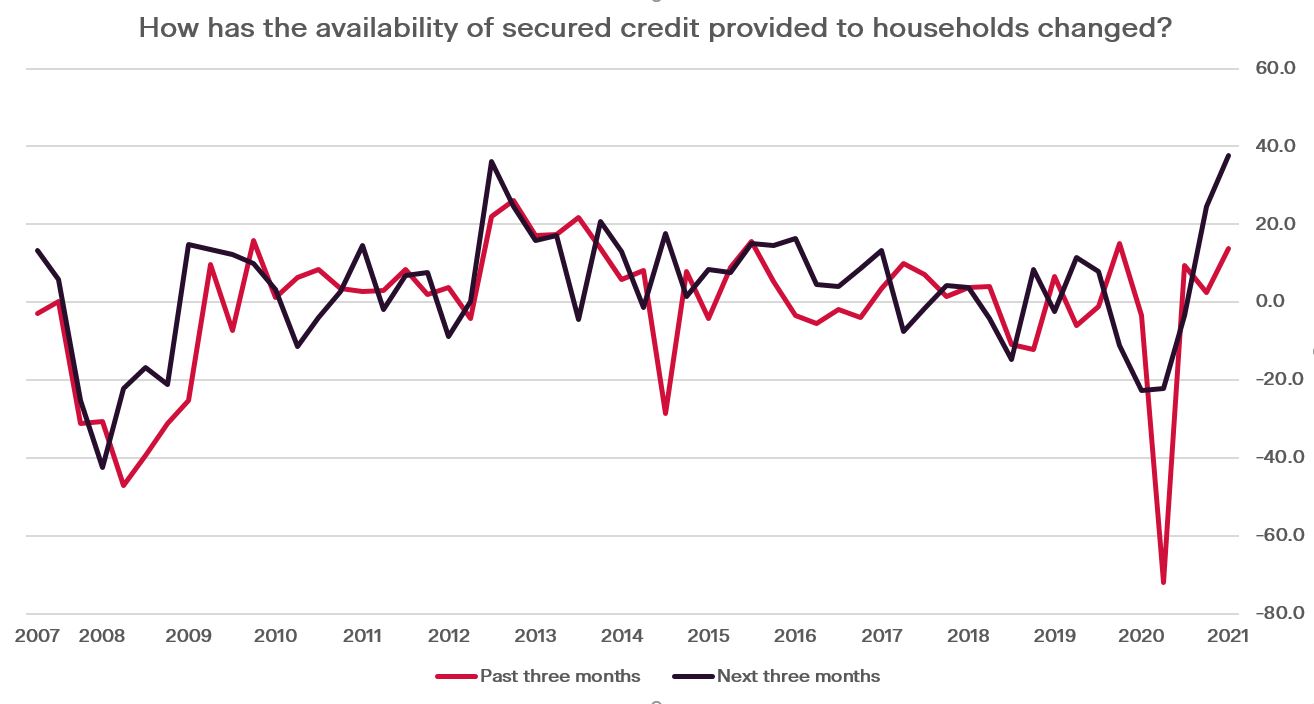

A net balance of +37.6 of survey respondents said they planned to increase secured credit provided to households (another term for mortgage lending) over the next three months. That’s the highest reading on record.

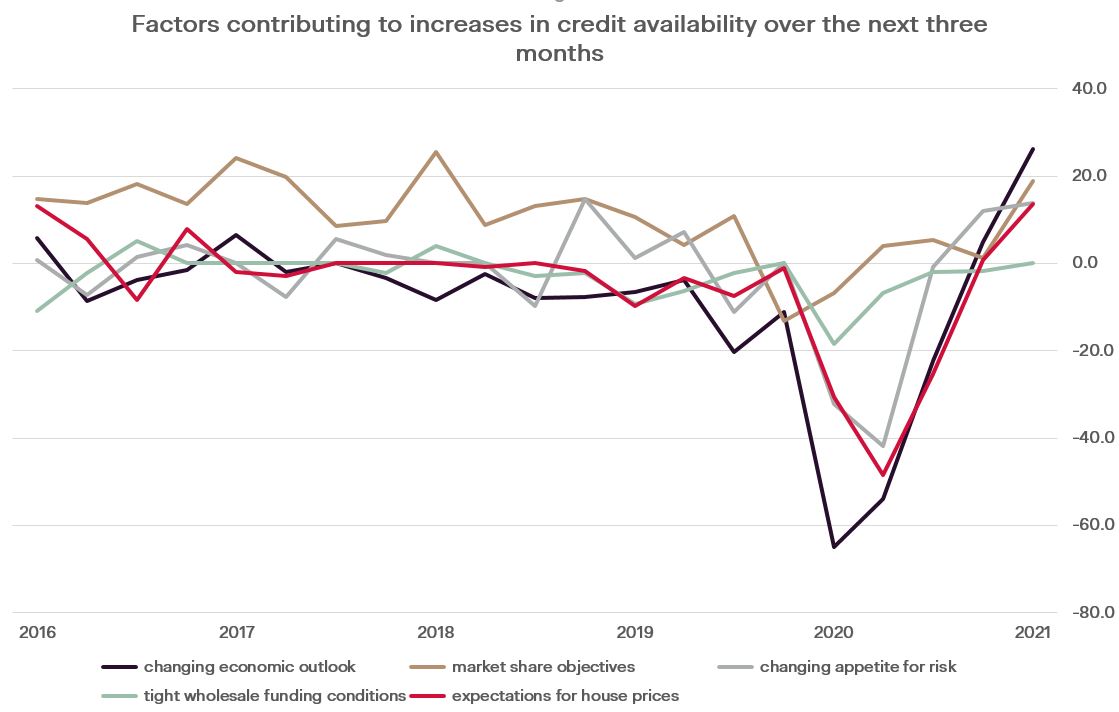

Lenders say the three most significant factors behind plans to increase lending in the near term are; the improving economic outlook, goals to build market share and an increased appetite for risk.

Willingness to lend to borrowers with small deposits has soared, which will be particularly welcome news to first time buyers. Economic conditions have improved to such a degree that Bank of England officials have made several downward revisions to unemployment forecasts. The next revisions, due in May, are likely to say unemployment will peak below the 7.75% it forecast just last month.

The more positive outlook for jobs is a big factor contributing to brighter lending conditions for buyers with smaller deposits.

Simon Gammon, Managing Partner of Knight Frank Finance, said:

“The lenders are clearly convinced the economic scarring from the pandemic will be substantially less than feared."

“This is great news for buyers with smaller deposits, many of whom were frozen out of the market during the depths of the crisis in late 2020. Improvements in lending conditions could enable significant numbers of first time buyers to get on the property ladder who otherwise wouldn’t have been able to do so."

“We expect the increasingly competitive market will be good news for borrowers at both ends of the property ladder as the lenders compete for market share by increasing the range of products on offer while being ultra-competitive on price.”

If you, a family member or friend is looking to buy a property in 2021 and would like to discuss the options when it comes to securing a mortgage, speak to us. We know all the major lenders in the marketplace and can help find the most cost-effective and suitable mortgage for you.