Are Lifetime Mortgage rates about to rise?

The markets are signalling Lifetime Mortgages could get more expensive, so now might be the time to lock in a deal, writes David Forsdyke, Head of Later Life Finance at Knight Frank Finance.

Consumers who understand the factors that influence the cost of mortgages can time their borrowing to lock in lower rates, potentially securing significant cuts in their outgoings.

The price of most mortgages are linked to the Bank of England’s base rate, for example, which is now at a record low 0.1%. That means most borrowers, particularly those at lower loan-to-value ratios, can enjoy ultra-low borrowing costs for longer.

However, not all mortgages are linked to the BOE base rate. Lifetime Mortgages, which have become the most common form of equity release, are one of the exceptions, and financial markets are signalling rates could be about to rise.

How it works

Lifetime Mortgages allow homeowners over the age of 55 to borrow without the need to make monthly payments. Interest can be paid each month if you choose to do so, or it can be allowed to roll up on top of the loan.

Pension funds and annuity providers are the money behind most Lifetime Mortgages. They like to lend in this market because interest rates, which make up their returns, are fixed for long periods. That means investing in Lifetime Mortgages offers a handy equivalent to buying gilts, also known as UK government bonds, and other fixed-interest securities.

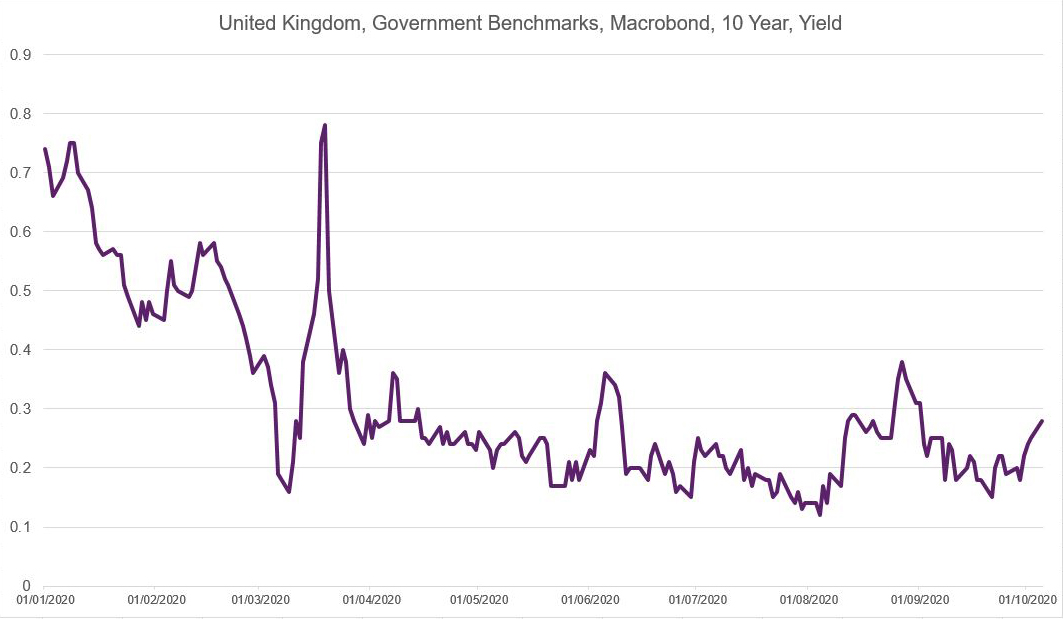

As a result, the rates on Lifetime Mortgages tend to move in tandem with long-term gilts. The 10 year gilt dropped from 0.71% to a low of 0.12% between January and August. In the same period, rates on the cheapest Lifetime Mortgages have dipped below 2.3%, and these rates are fixed for life.

By way of example, a 75 year old borrowing no more than 28% of the value of their property would be able to do so at a fixed rate of 2.25%. Such low rates are making this form of long-term borrowing attractive for older homeowners, particularly those that need smaller amounts.

There are now signs we have reached the bottom of the curve for Lifetime Mortgage rates. Yields on 10 year gilts climbed from 0.12% at the start of August to 0.28% as of Monday 5th October (see chart), and longer term gilts are also showing early signs of recovering. History tells us the cost of Lifetime Mortgages will follow suit.

Advice is essential

The interest rate is one of several factors you must consider when deciding whether to opt for a Lifetime Mortgage. Flexibility, exit fees and your plans for the future all play a part, so it’s important to seek advice from a trusted professional.

If you’re interested in discussing Lifetime Mortgages, other equity release products, or would like an informal chat about your finances, please get in touch.