Fixed or tracker? The difference is narrowing

![News Article Image]()

The Bank of England’s decision to raise the base rate to 3.5% will further narrow the gap between fixed rate mortgages and tracker rate mortgages.

For several months, the gap between tracker and fixed rate products has been elevated compared to historic norms - a trend compounded by the mini-budget.

The cost of many fixed rate products soared above six percent following the former Chancellor’s speech on September 23rd, while the best tracker products remained at around 3.5% - or around 0.5% above the base rate.

That's why for many borrowers it made sense to wait on penalty-free tracker products until fixed rate products started to fall, and they eventually did start to fall. As of mid-December, the five-year fixed rate products could be found as low as 4.6%.

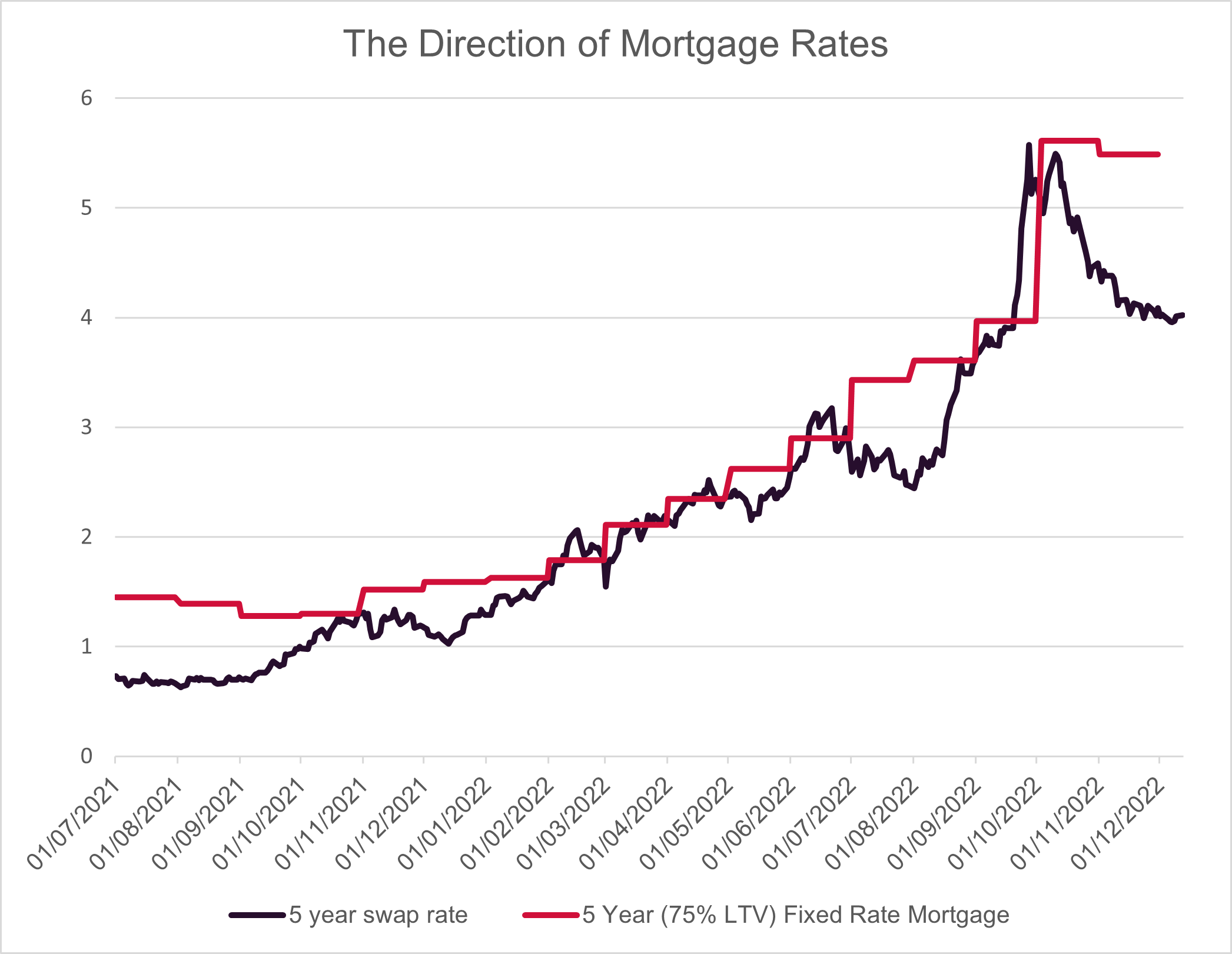

Today (Thursday 15th December), the Bank of England opted to raise the base rate to 3.5%, likely bringing the best tracker products to 4%. Swap rates – financial products used by lenders to price mortgages – have declined faster than mortgage rates, suggesting we’ll likely see more cuts to fixed rate products in late December and January (see chart). It could be as soon as late January or early February that fixed rate and tracker products converge or come close.

That will pose a tricky decision for borrowers. Some will choose to wait on trackers, betting that fixed rates will fall further, while others will opt to lock in a fixed rate product to get better visibility on their outgoings during what will be a difficult period from an economic perspective.

Everybody’s financial situation is unique and choosing the right mortgage product should be assessed alongside a range of factors, from security of income and levels of savings to appetite for risk and the likelihood of a change in circumstances.

Can’t decide what’s right for you? Why not speak to one of our expert advisors. We have access to more than 200 lenders and can offer a comprehensive overview of your options.