Conditions present tricky choices for wealthy home purchasers, for whom the decision to take on finance often rests on their ability to offset the cost of the mortgage debt via returns elsewhere.

The outlook for global interest rates and borrowing costs shifted dramatically during the final three months of 2023.

The decision by the Federal Reserve to hold rates steady during the December 13th meeting, issued alongside guidance from Federal Open Market Committee (FOMC) suggesting the possibility of three rate cuts in 2024, acted as a catalyst for a broad-based surge in asset prices. Official releases in the US, the UK and the Eurozone showing inflation falling rapidly also prompted a significant easing in the long-term interest rates that dictate the price of mortgage debt.

Swap markets suggest that many investors expect the Fed to execute six quarter-point rate cuts next year, double the number suggested by the central bank. The European Central Bank and the Bank of England are also expected to lower rates six times over the course of 2024 with the former starting in March or April and the latter in May.

Stocks and bonds surged on the news of the Fed’s pivot, leaving US equities close to all-time highs. That presents tricky decisions for wealthy home purchasers, for whom the decision to take on finance often rests on their ability to offset the cost of the mortgage debt via returns elsewhere.

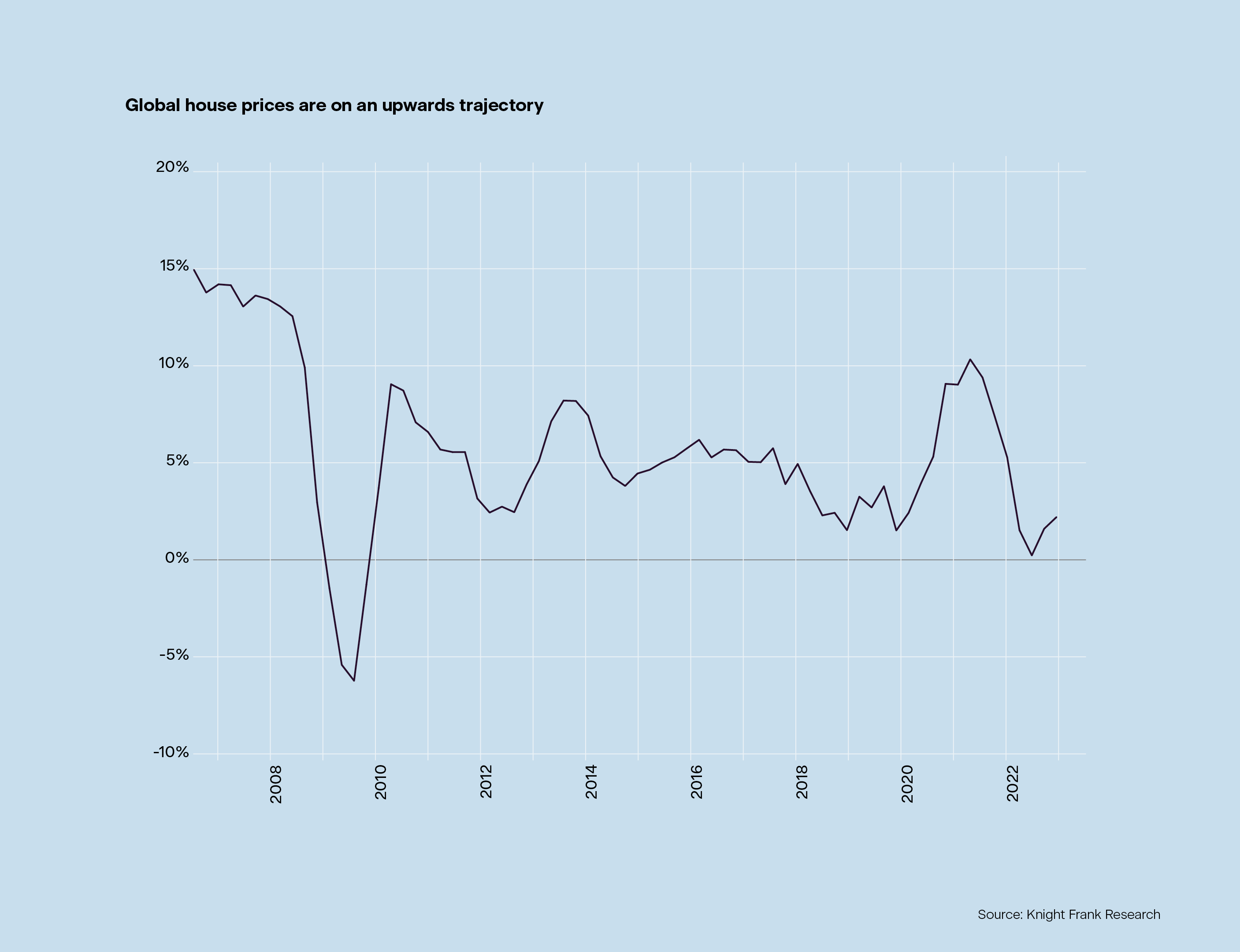

Globally luxury house prices have proved resilient despite steep increases in the cost of debt, due to a mixture of low stock availability - exacerbated by limited-new build construction - above-inflation wage growth and elevated household savings. Average annual price growth in prime global city markets ticked up to 2.1% in Q3 2023, up from 1.6% the previous quarter and well above the recent low of 0.2% recorded in the first quarter, according to the Knight Frank Prime Global Cities Index.

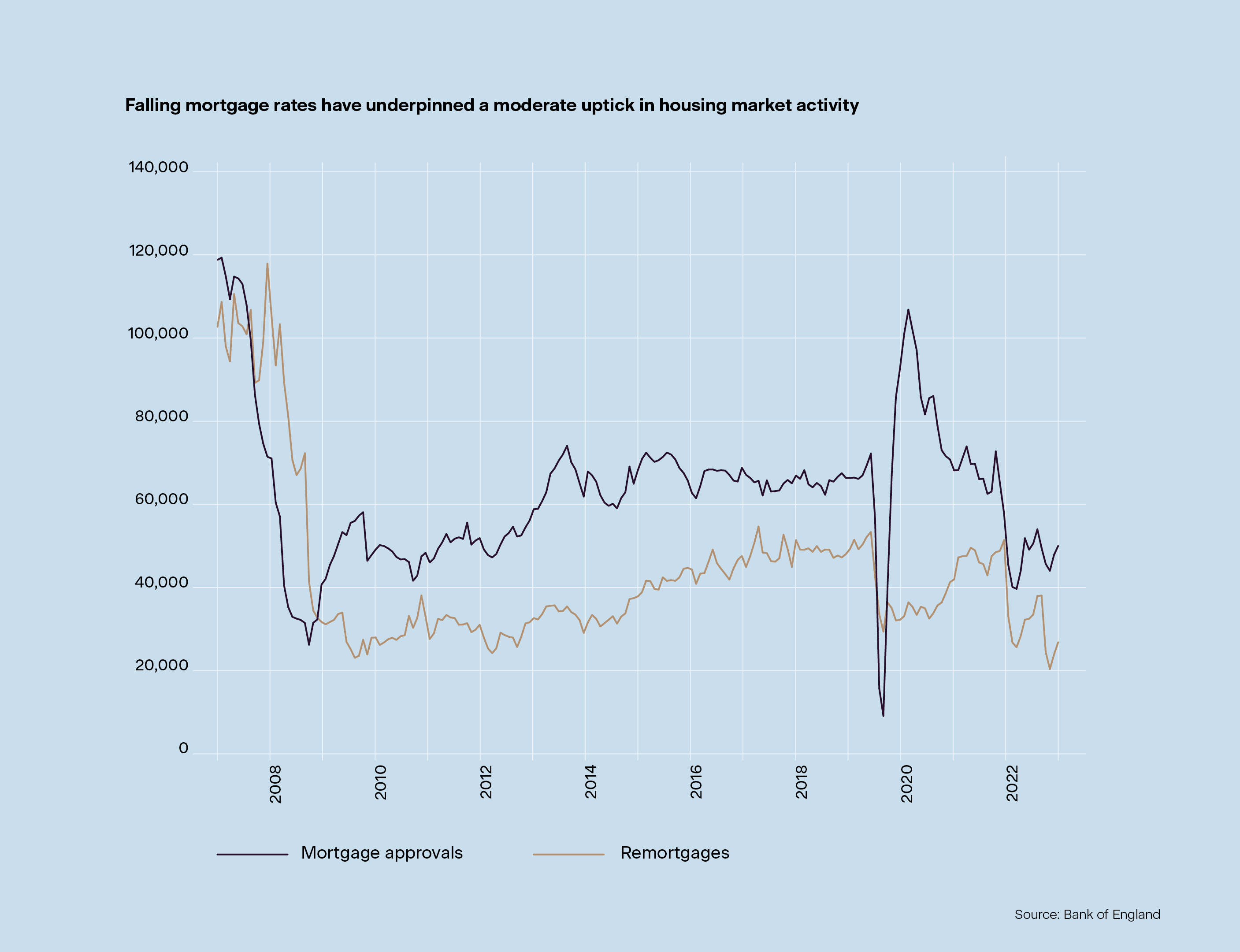

In the UK, mortgage rates have been easing since late July, which has underpinned a moderate recovery in housing market activity. Net mortgage approvals for house purchases, a good indicator of future borrowing, rose to 50,100 in November, according to the Bank of England. While that’s up from 47,900 the previous month, it’s still well below the 65,000 recorded in November 2019. The volume of cash transactions has continued to run above pre-Covid levels.

Falling mortgage rates will boost transaction activity as the year progresses. Overall, transaction volumes in London were 10% lower in the 12 months to November than the previous year, when numbers were boosted by a stamp duty holiday.

Average prices in prime Central London fell by 2.1% in the year to December, marginally less than Knight Frank’s forecast of -3%. In prime Outer London, the decline was 1.6%, outperforming a forecasted 3% drop.

Looking to 2024, there is a window of opportunity for buyers and sellers as the UK economy settles and before a general election is called. Prime Minister Rishi Sunak indicated on January 4th that any vote would take place in the second half of the year.

If you would like to discuss how the current market conditions may impact your property plans, or those of a client, please contact us at mortgages@knightfrankfinance.com. We have access to over 200 lenders, and can help find the right mortgage for you.