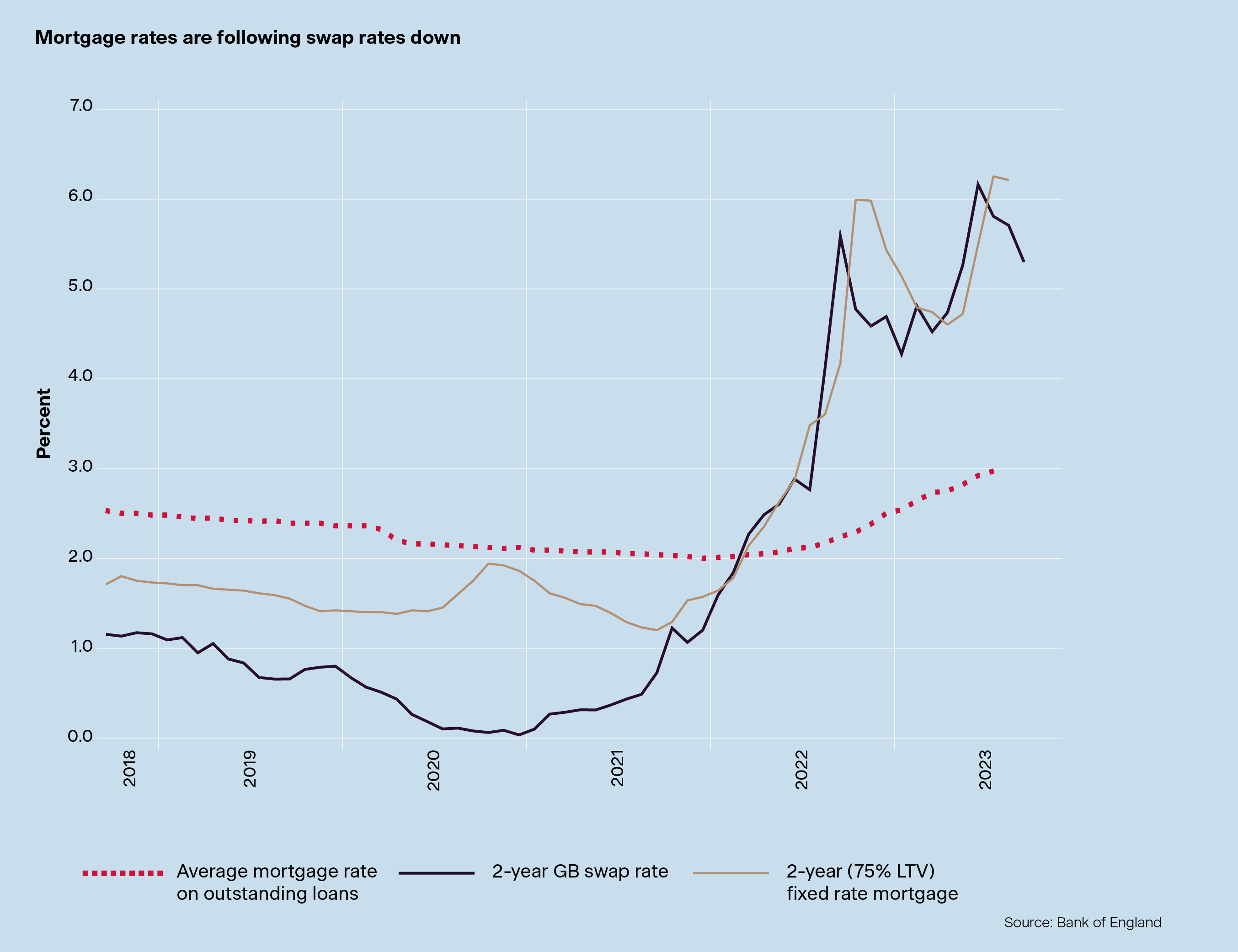

The path of mortgage rates arguably looks clearer now than at any point since the Bank of England began raising the base rate in 2021.

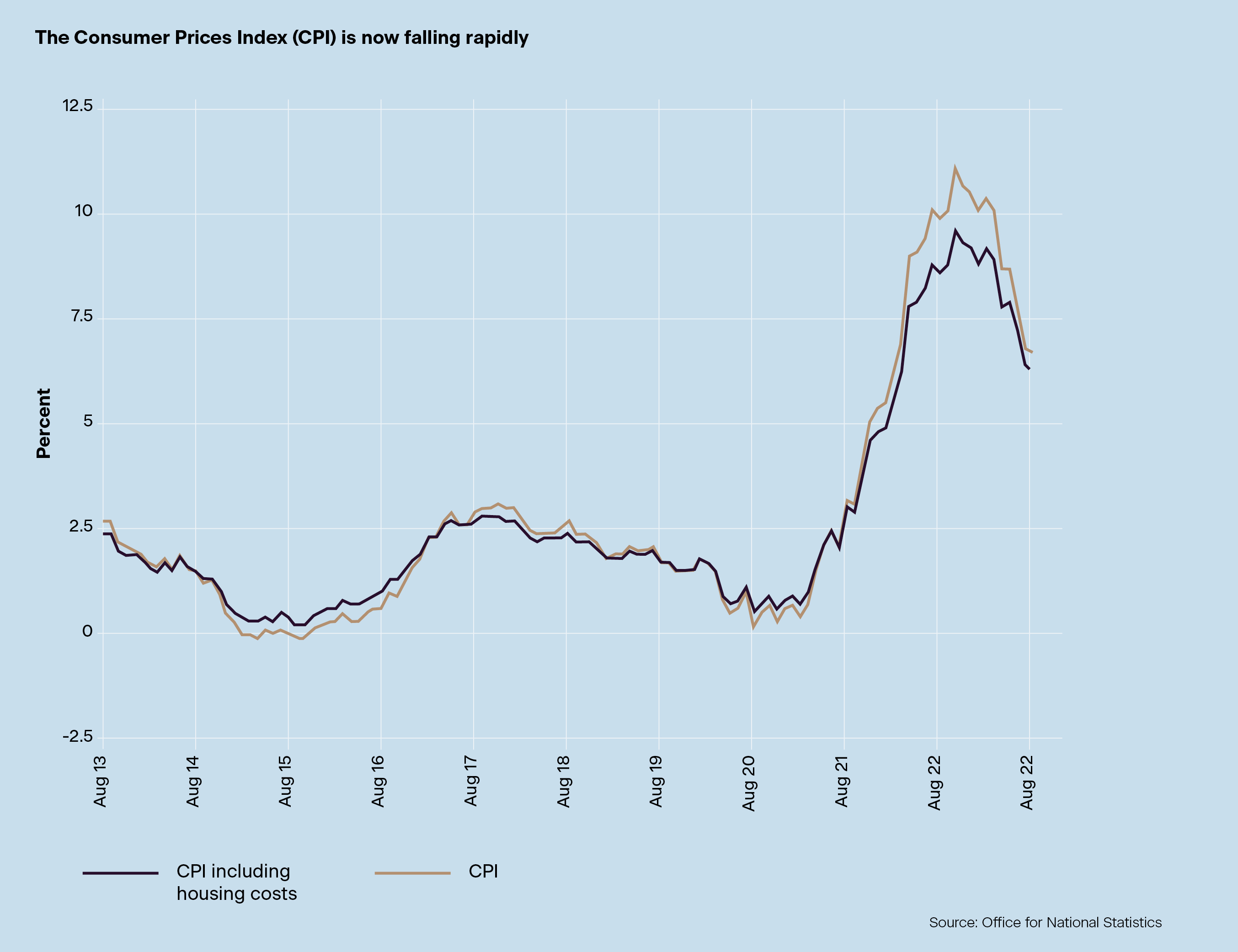

Inflation is now falling meaningfully. The UK’s headline rate slowed to 6.7% in the year to August 2023, down from 6.8% in July. Core CPI, which excludes volatile items like energy and food, slowed to 6.2%, down from 6.9%. Even the Services CPI, which is particularly susceptible to rising wages, slowed to 6.1% from 6.5%.

That data, plus several indicators suggesting that economic activity is weakening, paved the way for the Bank of England to hold the base rate at 5.25% on Thursday September 21st. Whether that decision represents the peak for the base rate or merely a pause will depend on whether the trends in August's inflation report are sustained. As of late September, investors had priced the chance of another hold at November’s meeting at about 70%, up from a coin flip before the September vote.

Swap rates have been easing since late July, when green shoots appeared in the official inflation figures. That gave lenders scope to cut mortgage rates, which has developed into a battle for market share amid subdued transaction activity.

Sub-5% fixed rate mortgages reappeared in September for the first time since June and will become more common during the months ahead. Sentiment in the property market will improve as a result, though mortgage rates will eventually reach a natural floor. Fixed rates starting with a four will be as good as it gets until rate cuts arrive, which could happen as early as May 2024, according to forecasts from US bank Citi.

These conditions present tricky choices for borrowers. A typical two-year tracker mortgage remains slightly cheaper than a two-year fixed rate product. Borrowers that opt for a tracker product could end up saving even more over the next two years if the Bank begins cutting the base rate next year as analysts expect. Of course, the trackers come with the upside risk that hiking resumes, but that risk will do little to dampen the rising pace at which borrowers are opting for floating rates.

The choice is a little more complicated for landlords, who can often borrow more if they opt for a fixed rate product.

Data published since the Bank of England’s September vote has built on evidence that the economy is slowing under the weight of higher borrowing costs. Private sector activity contracted for the second consecutive month in September at the fastest rate since the pandemic lockdown of 2021. The combination of weak demand and lower cost inflation contributed to the slowest increase in average prices charged since February of the same year.

Cooling inflationary pressures and the heightened risk of recession will increase pressure on the Bank of England to hold rates at their current level in November.

For more information, download your copy of The Mortgage Market in Minutes report here.

Interested in speaking to a broker to find out more? Contact us, mortgages@knightfrankfinance.com