Major lenders across the UK have announced new mortgage rate cuts this month, with deals under 5% now available.

Those searching for mortgage deals under 5% now have more choice, after several major UK lenders slashed their rates this November.

There are now 27 lenders offering a sub 5% fixed mortgage, compared to 13 at the start of October, according to Moneyfacts. New offers include deals from Halifax, HSBC, Yorkshire Building Society, Virgin Money, Bank of Ireland UK and Bank of Ireland UK for Intermediaries, who all revealed new sub-5% two-year fixed mortgages.

This will be welcome news to borrowers who have been hit hard with rising interest rates over the past two years. The Bank of England has increased its base interest rate 14 times since the end of 2021, with a current rate of 5.25 per cent held since August.

Following a sharp drop in UK inflation to 4.6% in the year to October, down from 6.7% in September, UK mortgage rates have been ticking down slowly since late July, and the brighter outlook has prompted some larger lenders to make more significant reductions.

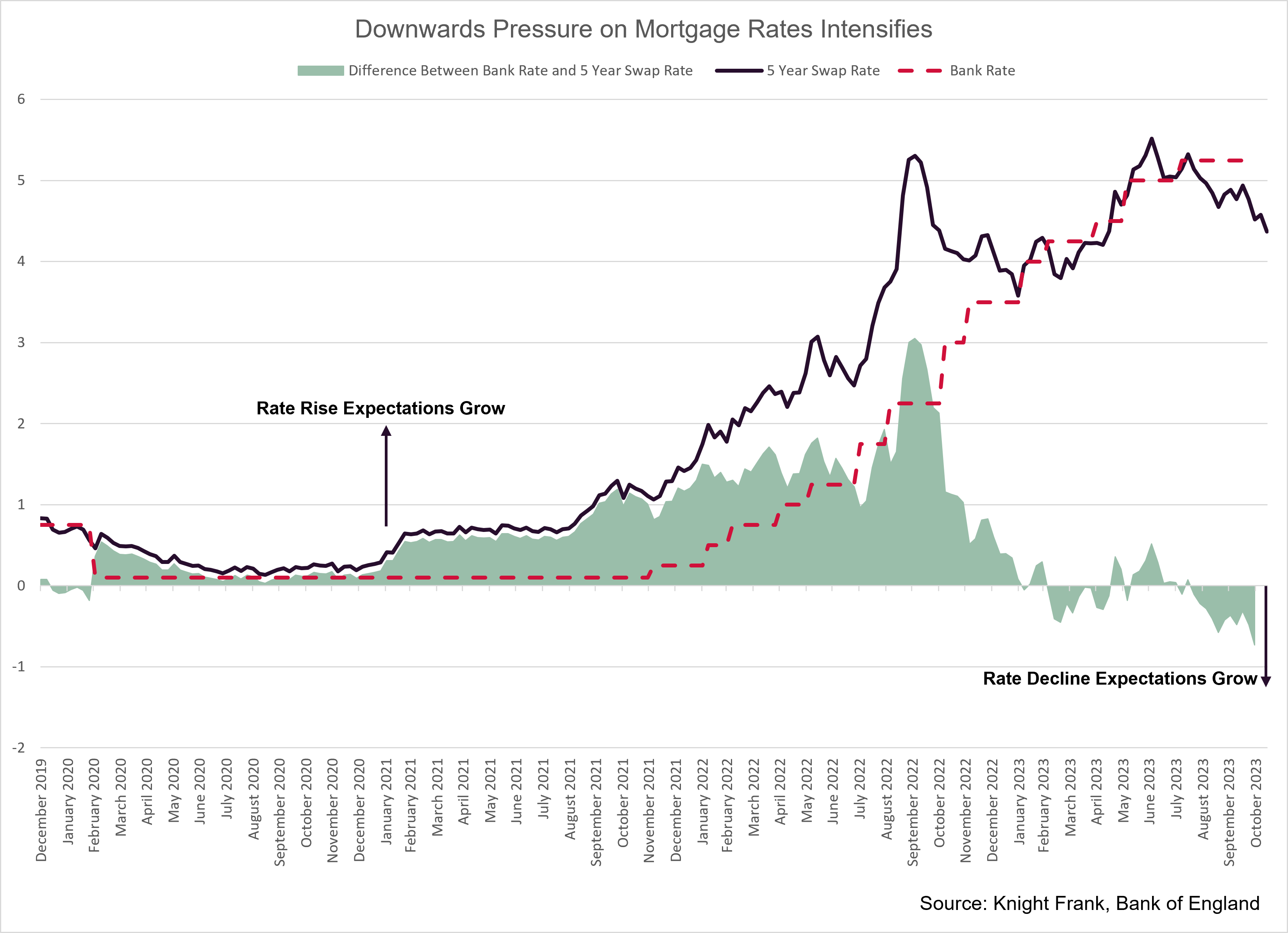

As Simon Gammon of Knight Frank Finance recently told the Times: "Inflation is coming down meaningfully and the Bank’s chief economist has said it’s reasonable to expect the first rate cut to arrive next summer. Regardless of whether that happens, the shift in sentiment has helped swap rates to ease, and lenders are eager to pass it on in the form of lower rates. All are doing less business than they would like to be and are eager to catch up where they can.”

The sharp drop in the headline rate was in part driven by a reduction in Ofgem’s price cap, reflecting lower wholesale gas prices, but there were positive signs on Core CPI, which dropped to 5.7% from 6.1%, and services prices, which fell to 6.6% from 6.9%. Core CPI has risen at an annualised month-to-month rate of just 2.2% over the last three months.

Speaking to the Independent, Simon added: “It’s now looking increasingly positive that peak mortgage rates are behind us and we are moving into a period in which mortgage rates, whilst higher than people are used to, are ultimately more manageable.”

If you are looking to secure a mortgage and would like to discuss your options, contact our expert mortgage team who would be happy to help. We’re a whole-of-market broker meaning we have access to all lenders in the marketplace, so are well-placed to help find a cost-effective mortgage for you. Get in touch here.